MetaTrader 4 has revolutionized forex trading by providing retail traders with institutional-grade tools previously available only to large financial institutions. This powerful platform combines advanced charting capabilities, automated trading features, and comprehensive market analysis tools in a user-friendly interface. Understanding how to trade forex using metatrader 4 can significantly improve your trading performance and simplify the complex process of navigating global currency markets.

The platform’s popularity stems from its ability to accommodate both novice and experienced traders through customizable features and extensive functionality. Whether you’re implementing basic trend following strategies or developing complex automated systems, MetaTrader 4 provides the necessary tools to execute your trading plan effectively. The platform’s reliability and comprehensive feature set have made it the preferred choice for millions of traders worldwide.

Getting started with MetaTrader 4 requires understanding its core components and learning how to leverage its powerful features. The platform offers numerous advantages that can help traders make more informed decisions and execute strategies with greater precision. This guide explores the essential steps to begin trading forex using MetaTrader 4 while maximizing its potential benefits.

Setting Up Your MetaTrader 4 Platform

The initial setup process for MetaTrader 4 determines your entire trading experience. Proper configuration ensures optimal performance and provides access to all necessary tools for successful forex trading. The platform installation process is straightforward, but customizing settings according to your trading style maximizes its effectiveness.

After downloading and installing the platform, connecting to your broker’s server establishes the link between your trading account and the global forex markets. This connection provides real-time price feeds, enables order execution, and grants access to historical data essential for technical analysis. A stable internet connection ensures uninterrupted trading and prevents potential losses from connection failures.

Customizing the platform interface improves trading efficiency and reduces the time needed to execute trades. MetaTrader 4 allows users to arrange windows, charts, and tools according to their preferences. This personalization creates a comfortable trading environment that supports quick decision-making and reduces potential errors during high-stress trading situations.

The platform’s workspace can be saved and restored, allowing traders to maintain consistent layouts across different trading sessions. This feature proves particularly valuable for traders who use multiple monitors or frequently switch between different trading strategies requiring specific chart arrangements and tool configurations.

Navigating the Trading Interface

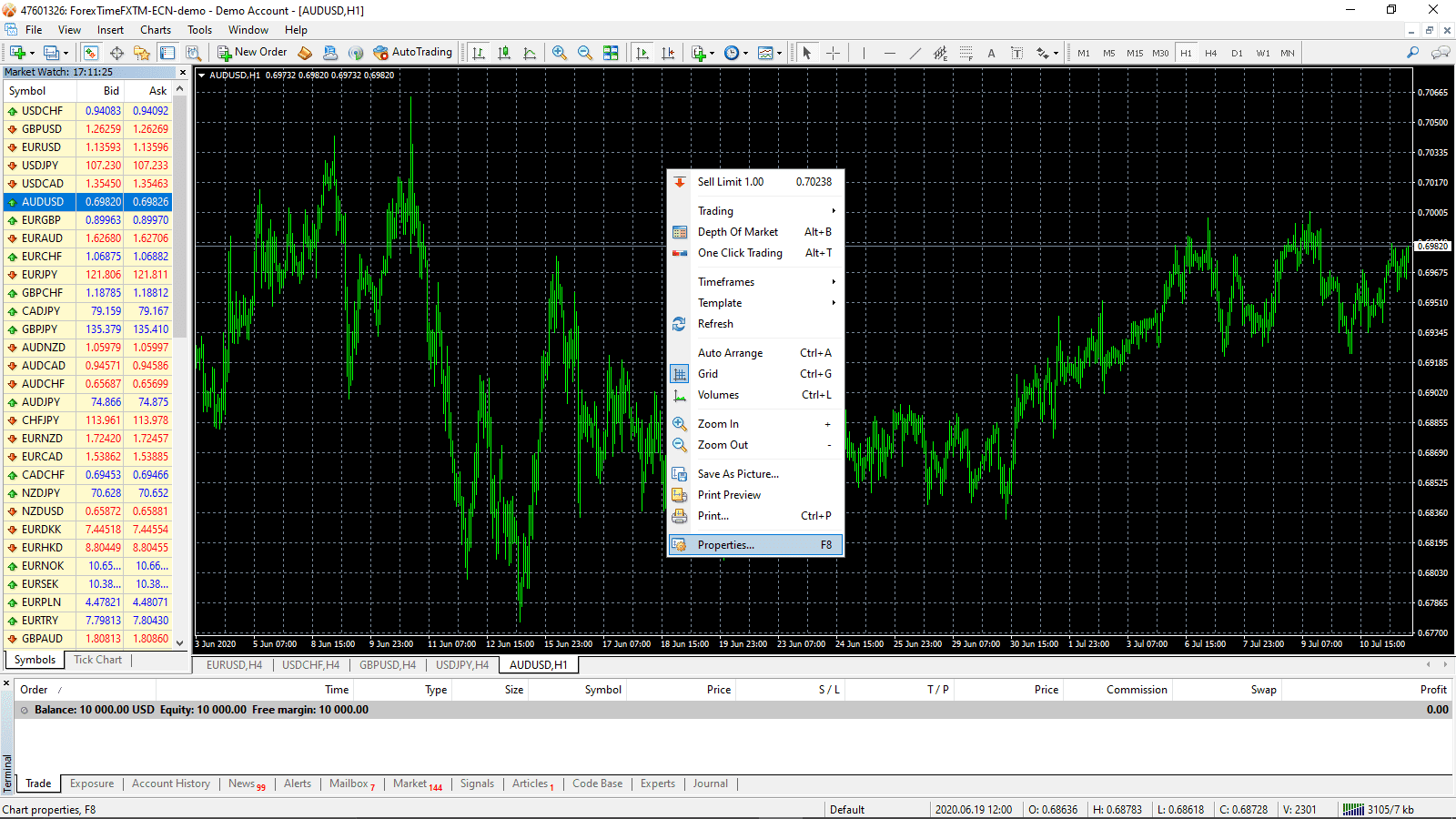

Understanding MetaTrader 4’s interface components enables efficient navigation and faster trade execution. The platform organizes information logically, with market watch windows displaying current prices, chart windows showing price movements, and terminal windows managing account information and trading history. Familiarity with these elements reduces confusion and improves overall trading performance.

The Market Watch window provides real-time bid and ask prices for all available currency pairs. This information updates continuously, allowing traders to monitor market movements and identify potential trading opportunities. The window can be customized to display only relevant currency pairs, reducing distractions and focusing attention on preferred trading instruments.

Chart windows represent the heart of technical analysis within MetaTrader 4. These windows display price movements over various timeframes, from one-minute charts for scalping strategies to monthly charts for long-term analysis. The ability to open multiple chart windows simultaneously enables comprehensive market analysis and comparison of different currency pairs or timeframes.

The Terminal window manages all trading-related activities, including open positions, pending orders, account history, and expert advisor operations. This centralized location provides complete oversight of trading activities and account performance. Regular monitoring of the Terminal window helps maintain awareness of current positions and overall portfolio risk exposure.

Executing Your First Trade

Placing trades through MetaTrader 4 involves a systematic process that ensures accurate order execution and proper risk management. The platform provides multiple methods for opening positions, including market orders for immediate execution and pending orders for future activation at specific price levels. Understanding these order types enables better trade timing and improved risk control.

Market orders execute immediately at current market prices, providing instant position entry when trading opportunities arise. This order type works best for trend following strategies and breakout trading where timing is critical. However, market orders may experience slippage during volatile market conditions, potentially affecting entry prices and overall trade profitability.

Pending orders offer greater control over entry prices by allowing traders to specify exact levels for position initiation. These orders include buy stop, sell stop, buy limit, and sell limit orders, each serving different strategic purposes. Pending orders prove particularly useful for range trading strategies and planned entries based on technical analysis levels.

Stop loss and take profit levels should be set immediately upon opening positions to manage risk effectively. MetaTrader 4 allows these levels to be specified during order placement or added after positions are opened. Proper use of these risk management tools protects trading capital and ensures profitable trades are secured at predetermined levels.

Utilizing Technical Analysis Tools

MetaTrader 4 includes comprehensive technical analysis capabilities that support various trading strategies and decision-making processes. The platform provides dozens of built-in indicators, drawing tools, and chart patterns that help identify market trends, support and resistance levels, and potential reversal points. Mastering these tools significantly improves trading accuracy and timing.

Moving averages represent one of the most fundamental and useful indicators available in MetaTrader 4. These tools smooth price data to reveal underlying trends and provide clear signals for trend following strategies. Different types of moving averages, including simple, exponential, and weighted averages, offer varying degrees of sensitivity to price changes.

Oscillators like RSI, MACD, and Stochastic help identify overbought and oversold conditions within currency markets. These indicators prove particularly valuable for range trading strategies and timing entries in trending markets. Understanding how to interpret oscillator signals and combine them with other technical tools creates more robust trading signals.

Drawing tools enable traders to mark important support and resistance levels, trend lines, and chart patterns directly on price charts. These visual aids help identify potential trading opportunities and provide reference points for setting stop loss and take profit levels. The ability to save and share chart templates preserves important analysis across different trading sessions.

Managing Risk and Money

Effective risk management through MetaTrader 4 protects trading capital and ensures long-term trading success. The platform provides various tools for controlling position sizes, setting stop losses, and monitoring overall portfolio risk exposure. Understanding these risk management features prevents catastrophic losses and maintains consistent trading performance.

Position sizing calculations determine the appropriate trade size based on account balance, risk tolerance, and stop loss distance. MetaTrader 4 allows traders to specify position sizes in lots, mini-lots, or micro-lots, providing flexibility for different account sizes and risk preferences. Proper position sizing ensures that individual trades cannot significantly damage overall account equity.