Running a small business today is not easy. To succeed, you must be fast, smart, and ready to change. One of the most important parts is how you handle your money. But many small business owners still use paper or spreadsheets.

Manual bookkeeping takes hours and often leads to mistakes in tax, bills, and payments. These issues can hurt your business and make it hard to grow. Thankfully, there’s a better way. Smart solutions like Account Software can help. They make tasks faster, reduce errors, and show you where your money goes.

Another great tool is the electronic invoice system. It lets you send bills online and track them with ease. Together, Account Software and an electronic invoice system give you full control over your business money. You can track payments, manage expenses, and prepare for tax time.

Switching to Account Software with a built-in electronic invoice system is a smart step if you want to save time and grow your business. These tools help calm the chaos, save money, and support smarter planning for long-term success.

Why Accounting Software Matters for Small Businesses

Small businesses have a lot to manage. Keeping track of money matters can feel tough, but Account Software makes it simple. It takes care of common jobs like:

– Sending invoices to customers

– Tracking payments and income

– Managing stock and purchases

– Viewing reports on sales and profit

– Staying ready for taxes and rules

Using these tools reduces mistakes. It shows you the full picture of how your business is doing.

Adding an electronic invoice system brings even more power. You can:

– Send neat, branded invoices fast

– Track when and if someone pays

– Get reminders if payments are late

– Stop using paper and save time

– Speed up the time it takes to get paid

This all helps your cash flow. It also keeps your records clean and easy to access. Most software today also stores your data safely in the cloud. So nothing gets lost, and you can view it any time, from anywhere

Vyapar: Smart Accounting Made for Indian Businesses

Looking for simple, secure Account Software? Vyapar is one of India’s best tools for small and medium businesses. It has everything you need—in one place—and it’s easy for anyone to use.

Here’s how Vyapar helps smart business owners every day:

GST-Friendly Invoicing and Accounting

Making GST bills is easy with Vyapar. The software adds the right tax, fills the forms, and helps prepare returns. No more math errors or lost bills.

Quick Electronic Invoicing

Need to send a bill today? Vyapar lets you send sharp, clear invoices in seconds. Customers can pay online using UPI, wallets, or bank transfers. Say goodbye to chasing late payments!

Expense and Stock Tracking

See where your money goes. With Vyapar, expenses show up clearly, and you can track every item in your shop. No more surprise shortages or forgotten orders.

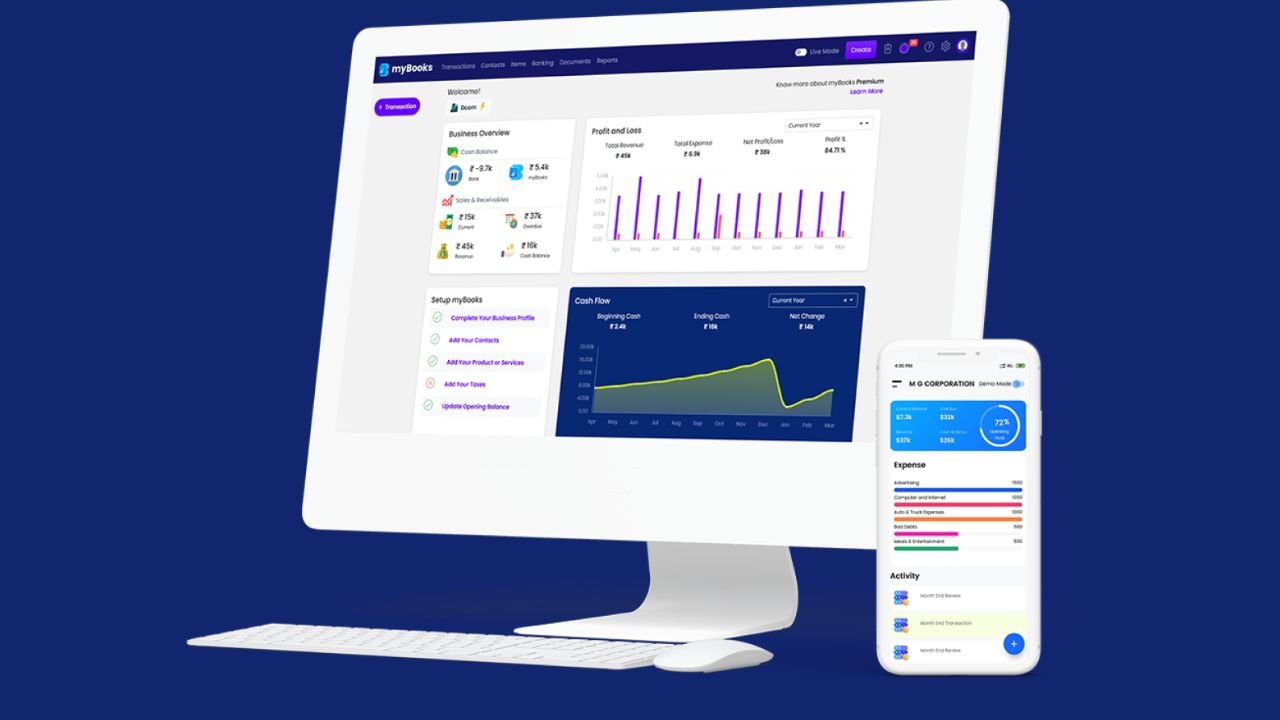

Watch Profit in Real Time

Vyapar helps you see how much money you’re really making. The system shows you income, costs, and growth through charts and reports.

Access Anywhere

Use Vyapar on your phone or computer—even offline! It syncs data when the internet comes back. Perfect for shops where the signal is weak.

🔗 Get full feature details here: [Vyapar Accounting Blog](https://vyaparapp.in/blog)

Common Mistakes Small Business Owners Can Avoid

Some businesses struggle with money tasks because they don’t use the right tools. Here are key mistakes to avoid:

1. Using the Wrong Software

Low-cost or basic tools may not support all your needs. Choose Account Software that helps with GST, inventory, invoices, and compliance—all in one.

2. Not Using Electronic Invoices

Paper bills are slow and messy. A smart electronic invoice system helps you send, track, and organize bills quickly. This means fewer delays and happier customers.

3. Skipping Staff Training

Even easy tools need some learning. Don’t forget to train your team. When everyone knows the software, work gets done faster and better.

4. Ignoring Software Updates

Outdated systems are risky. They may miss new tax rules or become unsafe. Vyapar gives regular updates to keep your business safe and running smoothly.

How to Use Your Accounting Software the Right Way

To get the most from your Account Software and stay ahead, follow these simple tips:

✅ Set Up with Care

Take your time at the beginning. Add correct taxes, item names, and your shop’s logo for invoices. A good setup saves time later.

✅ Automate Daily Tasks

Put reminders and repeat bills on auto mode. Link your bank or payment apps if possible. This cuts work and prevents mistakes.

✅ Back Up Your Data

Always keep your data safe. Vyapar offers cloud backup, so nothing gets lost. It also syncs across devices.

✅ Check Reports Monthly

Each month, review your profit, costs, and top sales. This helps you know what’s working and where to improve.

✅ Use All Features

Vyapar connects with your barcode scanner, POS, and GST returns. Use these tools together for a smoother business flow.

FAQs About Accounting and Invoicing Software

📌 What is the biggest benefit of using Account Software?

It saves time by automating billing, tracking, and reports. You make fewer mistakes and smarter decisions.

📌 Is digital invoicing legal in India?

Yes! Digital invoicing is allowed under Indian law. Vyapar’s invoice formats are GST-compliant and accepted everywhere.

📌 Can I use Vyapar offline?

Yes. Vyapar works offline. It updates your records once you’re back online.

📌 Is my data safe with Vyapar?

Absolutely. Vyapar uses encryption and backups to keep your data secure at all times.

Final Thoughts: Smarter Tools Equal Better Business

Small business success starts with simple steps. Using Account Software with an electronic invoice system helps you stay in control. You spend less time fixing errors and more time growing your business.

Vyapar delivers all the tools you need—billing, inventory, reports, taxes—in one simple app. It’s built for busy Indian businesses like yours.

Stop wasting hours on manual work. Switch to a smart system that brings peace of mind and clear numbers.