Investing is not just about where you invest—it’s also about how you invest and how you grow your investments over time. Among mutual fund strategies, the Step-Up SIP (Systematic Investment Plan) has emerged as a powerful tool for those aiming to build long-term wealth—especially when paired with the high-growth potential of small cap mutual funds in India.

What adds real power to this strategy is the use of a SIP calculator, like the one offered by Rupeezy, to model your financial journey and predict how increasing your SIP contributions every year can maximize your wealth.

In this article, we’ll explore what Step-Up SIPs are, why they work brilliantly with small cap funds, and how to use a SIP calculator to make the most of this approach—even in a volatile market.

What Is a Step-Up SIP?

A Step-Up SIP, also known as a Top-Up SIP, is a feature that allows investors to automatically increase their monthly SIP contributions every year by a fixed percentage or amount.

This strategy aligns your investments with income growth. As your salary increases annually, so does your investment—resulting in significantly higher returns over time.

Key Features of Step-Up SIP:

- Increases SIP amount periodically (typically every year)

- Helps beat inflation with rising contributions

- Encourages wealth creation without large upfront investments

- Ideal for long-term goals like retirement or education

Why Step-Up SIP Is Ideal for Small Cap Mutual Funds

small cap mutual funds in india are known for their:

- High return potential

- Greater market volatility

- Long-term wealth-building capabilities

Since small cap funds experience cycles of highs and lows, investing a growing SIP amount means you’re buying more units when prices are low and maximizing returns when prices rise.

Benefits of combining Step-Up SIP with small cap funds:

- Accelerated compounding with larger contributions over time

- Rupee cost averaging during volatile market phases

- Disciplined investment behavior with automated growth

- Higher wealth creation without needing a large monthly SIP from day one

How SIP Calculators Help Plan Step-Up SIPs

A sip calculator is an online tool that helps estimate the maturity amount of your SIP based on:

- Monthly SIP amount

- Expected annual return (CAGR)

- Investment duration

But advanced SIP calculators like the one from Rupeezy allow you to model Step-Up SIPs by factoring in:

- Annual SIP increment (fixed ₹ amount or % increase)

- Realistic return assumptions (8%, 10%, 12%, etc.)

- Long-term investment periods (10, 15, 20 years)

This helps you visualize how your wealth can grow faster by simply increasing your SIP each year.

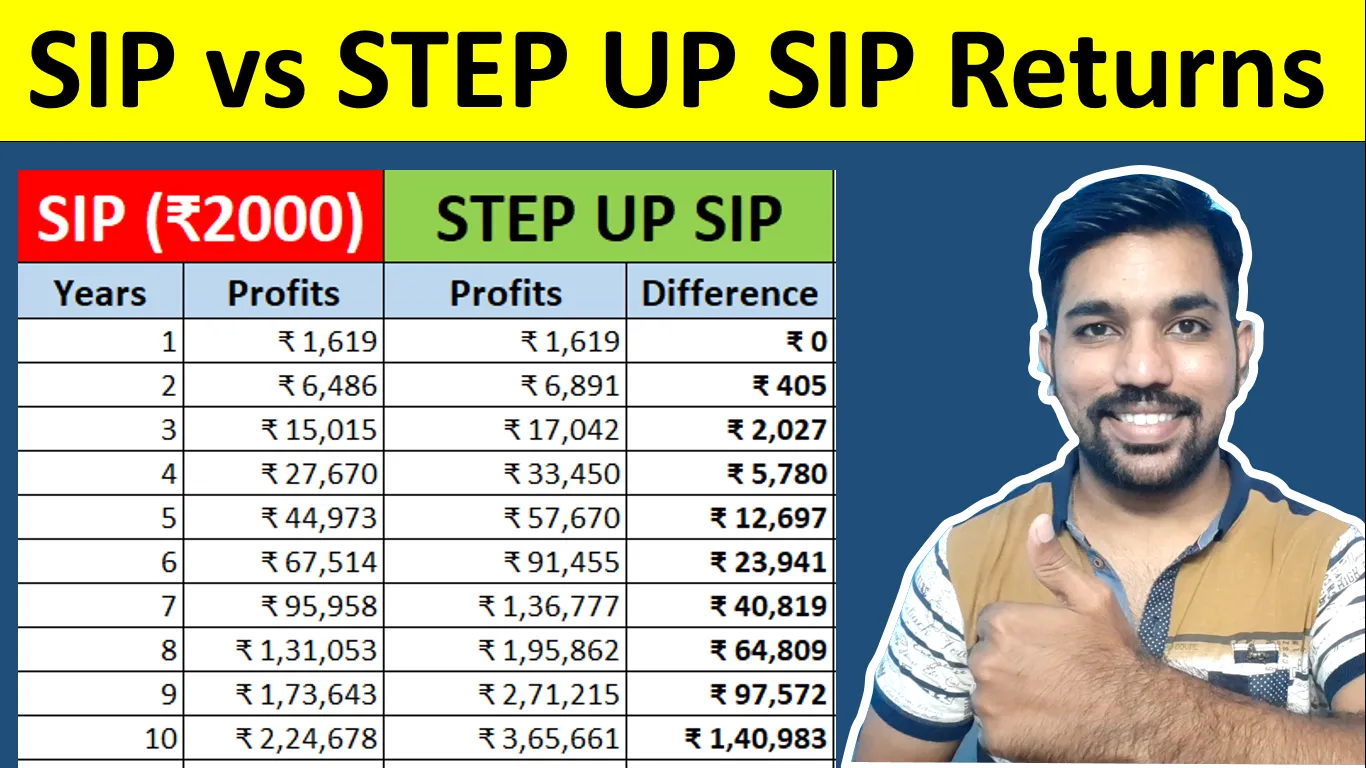

Step-Up SIP vs Regular SIP: Why It Matters

Let’s compare a regular SIP and a Step-Up SIP to see the difference using Rupeezy’s sip calculator.

Regular SIP Example:

- Monthly SIP: ₹5,000

- Duration: 15 years

- Expected CAGR: 12%

- Maturity Value: ₹24.9 lakhs

- Total Investment: ₹9 lakhs

Step-Up SIP Example (10% annual increase):

- Starting SIP: ₹5,000

- Annual Increase: 10%

- Duration: 15 years

- Expected CAGR: 12%

- Maturity Value: ₹35+ lakhs

- Total Investment: ₹13–14 lakhs

Observations:

- By just increasing your SIP 10% annually, you earn ₹10+ lakhs more

- This strategy requires no lump sum investment and is aligned with income growth

How to Use Rupeezy’s SIP Calculator for Step-Up SIPs

rupeezy offers an intuitive SIP calculator that allows you to project your SIP investments with or without step-up features.

Steps to use:

- Enter your starting SIP amount (e.g., ₹5,000)

- Select investment duration (e.g., 15 years)

- Choose expected annual return (e.g., 12%)

- Use the Step-Up option to increase SIP by:

- A fixed amount (e.g., ₹500 per year), or

- A percentage (e.g., 10% per year)

- Review your:

- Total investment

- Estimated returns

- Maturity value

This makes it easy to compare multiple strategies and choose what suits your goals.

Ideal Use Cases for Step-Up SIP in Small Cap Funds

Step-Up SIPs work best when:

- You’re early in your career and expect income to rise steadily

- You’re investing for long-term goals like retirement or child’s education

- You prefer to start small but scale up commitment over time

- You’re investing in volatile funds like small caps that benefit from rupee cost averaging

Goals you can plan with Step-Up SIPs:

- Build ₹1 crore retirement fund

- Fund higher education for your child

- Create wealth for a second home

- Build capital for entrepreneurship

With small cap mutual funds and a well-planned step-up SIP, these goals become realistically achievable.

Best Practices to Maximize Step-Up SIPs

Start Early

- Even a small SIP today grows big with time and step-up increments.

Review Annually

- Revisit your SIP and adjust based on income or life goals.

Avoid Overestimating Returns

- Use conservative CAGR values (10–12%) to plan wisely.

Stay Consistent During Market Volatility

- Step-Up SIPs help you buy more when markets are low.

Diversify

- While small caps offer high growth, mix them with mid and large-cap funds to balance risk.

Why Rupeezy Is the Ideal Platform

Rupeezy isn’t just a tool—it’s an investment partner that simplifies the process of wealth creation with mutual funds.

Here’s why investors trust Rupeezy:

- User-friendly sip calculator with step-up planning

- Access to top-rated small cap mutual funds in India

- Goal-based investment planning tools

- Zero commission and transparent tracking

- Educational content to guide first-time and experienced investors

With Rupeezy, you can plan a long-term strategy that grows as you grow—without needing to worry about timing the market or committing large sums upfront.

Final Thoughts

In the pursuit of long-term wealth, it’s not just about choosing the right fund—it’s also about investing the right way. A Step-Up SIP is one of the smartest ways to grow your investment gradually while reaping the benefits of compounding and rupee cost averaging—especially in high-growth vehicles like small cap mutual funds in India